Since its announcement by billionaire then–Prime Minister Bidzina Ivanishvili, the Georgian Co-Investment Fund has began to reshape Georgia’s capital. OC Media set out to unmask the backers of the project, but with the money channelled via murky offshores, this proved to be somewhat impossible.

Since its announcement by billionaire then–Prime Minister Bidzina Ivanishvili, the Georgian Co-Investment Fund has began to reshape Georgia’s capital. OC Media set out to unmask the backers of the project, but with the money channelled via murky offshores, this proved to be somewhat impossible.

In September 2016, Georgian Prime Minister Giorgi Kvirikashvili attended the cornerstone laying ceremony for Heidelberg Cement’s new plant in Kaspi. The event was intended to emphasise the multinational company’s commitment to Georgia’s development.

Hunnewell Partners

Hunnewell Partners was formed in the UK in 2011. It manages assets from the estate of Georgian oligarch Badri Patarkatsishvili, who died suddenly in 2008. It has offices in Kyiv, London, Miami, Tbilisi, and in the British Virgin Islands.

There was just one problem. Funding for the project came from three parties, but only one was represented at the event. Heidelberg had partnered with the Georgian Co-Investment Fund (GCF), and Hunnewell Partners [see fact-box] to fund the $120 million expansion. What contribution the Georgian Dream government made to the project — if any — was never elucidated.

With the event taking place so close to the October 2016 parliamentary elections, it smacked of electioneering of the worst kind. It again raised the question that has dogged the GCF since it was established in 2013. Where is the line between the Georgian Co-Investment Fund and the Georgian Dream Government? or, is there one at all?

Panorama’s mystery backers

In April 2014, six months after the GCF’s launch, they announced a massive multi-million dollar real estate development project that would transform the face of Georgia’s capital. Panorama Tbilisi ‘is one of the biggest ever real estate developments in Georgia’s history’, the announcement boasted. According to the GCF’s website, they are investing nearly $600 million in real estate development projects around the city. The majority will be in luxury hotels, with the remainder in a shopping centre on Freedom Square.

The plans have met multiple protests from local residents and activists, who are worried about the environmental impact, the potential termination of Tbilisi’s application for UNESCO world heritage status, and the implications for their daily lives.

The GCF has shown little interest in engaging with the public about these concerns. Rather it has charged ahead with its ambitious plans to remake the capital. This is, I believe, due to the lack of transparency surrounding the Fund.

[Read on OC Media: How and why a piece of central Tbilisi was sold for ₾1]

Unlike the government backed Partnership Fund, the GCF’s financing supposedly comes entirely from private sources. But who these private backers are is still a mystery. It’s unclear, for example, how much of the money invested in these projects is from former Prime Minister Bidzina Ivanishvili, and how much is contributed by other partners whose identity remains largely concealed.

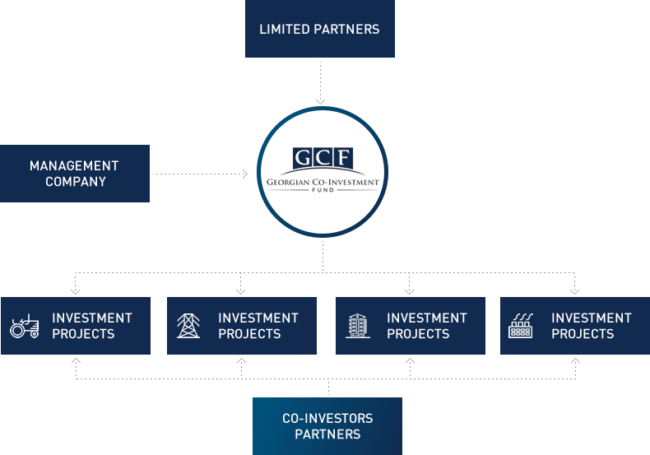

When the GCF was launched in 2013, then Prime Minister Ivanishvili declared that he had committed $1 billion of his own money, with other partners kicking in as they saw fit. But the structure of the company and its subsidiaries, located in overseas tax havens, make this impossible to prove. After spending nearly a year looking into the GCF’s structure, attempting to unravel the tangle of names and companies, the question of who is behind the GFC and to what extent has remained largely unanswered.

From the Caymans to Hong Kong

According to Transparency International Georgia, the GCF is registered in the Cayman Islands and has two subsidiaries, one in Luxembourg and one in Hong Kong.

The GCF has never revealed any details about these offshore entities. Cayman is notoriously opaque, popular with investors seeking to conceal their identity while channeling money into the US market. There are multiple companies using the acronym GCF in Luxembourg, as well as in Hong Kong. Looking at the paperwork filed in Georgia’s public registry only raises more questions than it answers.

George Bachiashvili

GCF CEO George Bachiashvili was born in Moscow in 1985. He moved to Georgia as a child, where he attended school and university. He then began his career with Bank of Georgia. Bachiashvili has worked for Dhabi Group, Booz & Co in Moscow, and Bidzina Ivanishvili’s Unicor. He has an MBA from INSEAD.

The Georgia-registered GCF Partners manages the Fund. It was initially split between GCF Chairman George Bachiashvili (42%) [see fact-box], and Ivanishvili’s cousin, Ucha Mamatsashvili (42%), with the remaining 16% held by businessman Levan Vasadze. However, the most recent filing with the Public Registry shows that the company is now divided evenly between Bachiashvili and Mamatsashvili. When asked by Transparency in 2013 about the role Mamatsashvili and Vasadze were meant to play, Bachiashvili downplayed their significance, saying they ‘don’t have any active involvement or access to the funds which are managed by GCF Partners’.

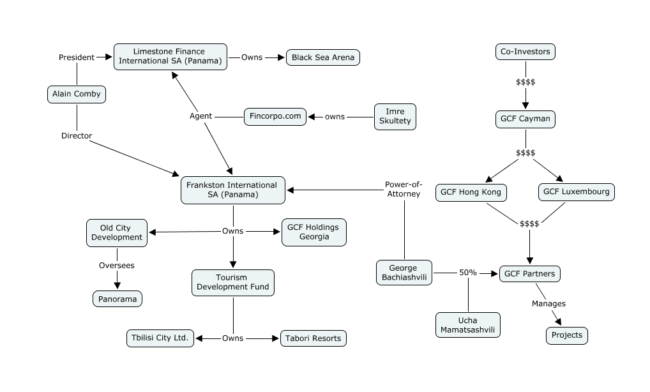

GCF Holdings Georgia LLC has an undefined role in the structure of the Fund. It is solely owned by Frankston International SA, which was registered in Panama in December 2011. But no information about the real owners is available. Frankston has owned Old City Development, which is overseeing the Panorama project, since April 2014, according to Transparency International Georgia. It also owns Georgia’s Tourism Development Fund, which is overseen by Irakli Karseladze. Frankston granted power of attorney to George Bachiashvili in July 2016 according to documents filed with Georgia’s Public Registry], allowing him to act on Frankston’s behalf in Georgia.

Alain Comby

Alain Comby is listed on nearly 300 companies in Panama, the UK, and Cyprus. He uses multiple addresses dotted around the globe, including Australia, France, and Panama. Comby has also been named in relation to a 2015 $40 million embezzlement scandal in Ukraine involving another Panamanian offshore, Kingston Group SA. Comby is also listed as the director of Limestone Finance International SA in Panama, which is the sole shareholder of the Black Sea Arena on Georgia’s Black Sea Coast. The stadium was officially opened in summer 2016.

One director of Frankston is Alain Comby [see fact-box], who is the principle of a company called FinCorpo.com. The company offers services in English, French, and Russian. Its website is registered to Imre Jenoe Skultety. Skultety [see fact-box] is also named as the representative for Swiss registered FinCorpo.com and Legal Services SA. The company still uses bearer shares, meaning that the person holding the physical paper shares is the owner, and there is no other record of ownership. The practice of using bearer shares has been slowly outlawed around the world, and only a few jurisdictions allow them anymore.

Why is George Bachiashvili acting for a Panamanian company? And who does the company ultimately belong to? This is not clear. And there is simply no way to resolve these questions without more openness from Bachiashvili and Ivanishvili.

A lack of accountability

Imre Skultety

Imre Skultety appeared in the Canadian press last year in an expose on the use of tax havens. In addition, his Swiss company, Tailor Made Asset Management SA, was allegedly providing false balance sheets to conceal the fact that Bidzina Ivanishvili’s Swiss banker was embezzling money. Skultety is also a representative of the EurAsian Economic Centre for Legal Analysis, Information and Investment Support, and has attended the St Petersburg International Economic Forum in this capacity in the past.

The GCF’s stated goal of bringing outside investment into Georgia is not bad. Its commitment to improving the country and offering outside investors an opportunity to take part in its development should be commended. But their investment choices are questionable, at best. Why does a city the size of Tbilisi need another half a dozen luxury hotels and a golf course? The justification for a financial commitment of over half-a-billion dollars has not been satisfactorily made.

The lack of transparency surrounding the GCF means that there is no way for society to hold the Fund accountable for its actions. Protests have proven to be futile because the organisers don’t know to whom to appeal. Ivanishvili? Bachiashvili? Nameless foreign investors who live and work overseas? Protesting is viewed now as a way for Georgians to let off steam, without ever addressing the underlying issues.

Civil society groups and journalists have been unable to find answers either, raising questions about the Georgian government’s actual commitment to anti-corruption efforts. All of this, combined with the government’s electioneering, is damaging to both Georgia’s reputation and development.

GCF’s promotional video of the Panorama project.

This article was prepared with support from the Friedrich-Ebert-Stiftung (FES) Regional Office in the South Caucasus. All opinions expressed, and terminology used are the words of the author alone, and may not necessarily reflect the views of FES or the OC Media editorial board.