The EU’s plan to phase out natural gas imports from Russia by 2028 looks set to bolster BP-led energy projects in Azerbaijan, which already supplies gas to Europe and is aiming to expand its exports.

In October, the energy ministers from nearly all EU member states backed a draft regulation to end both pipeline and liquefied natural gas (LNG) imports from Russia. The proposal would prohibit new Russian gas contracts from January 2026, phase out short-term deals by June that year, and terminate long-term agreements by January 2028.

If approved by the European Parliament, the measure would be a boon for Azerbaijan’s natural gas projects, most of which are operated by the British energy major.

While the EU has been slashing Russian gas purchases since the launch of Russia’s full-scale war against Ukraine in 2022, some members — including Hungary and Slovakia — continue pipeline imports. Others such as France, Spain, and the Netherlands still buy Russian LNG. Overall, however, the trend is a downward one, with Russia supplying about 13% of the EU’s gas needs in 2024, down from 45% in 2021.

As a part of lessening their reliance on Russian gas, the European Commission signed a memorandum of understanding with Baku in July 2022 to double imports from Azerbaijan to 20 billion cubic metres a year by 2027. At the time, European Commission President Ursula von der Leyen, who visited Baku to personally oversee the signing of the deal, called Azerbaijan a ‘reliable partner’.

‘King of the Sea’

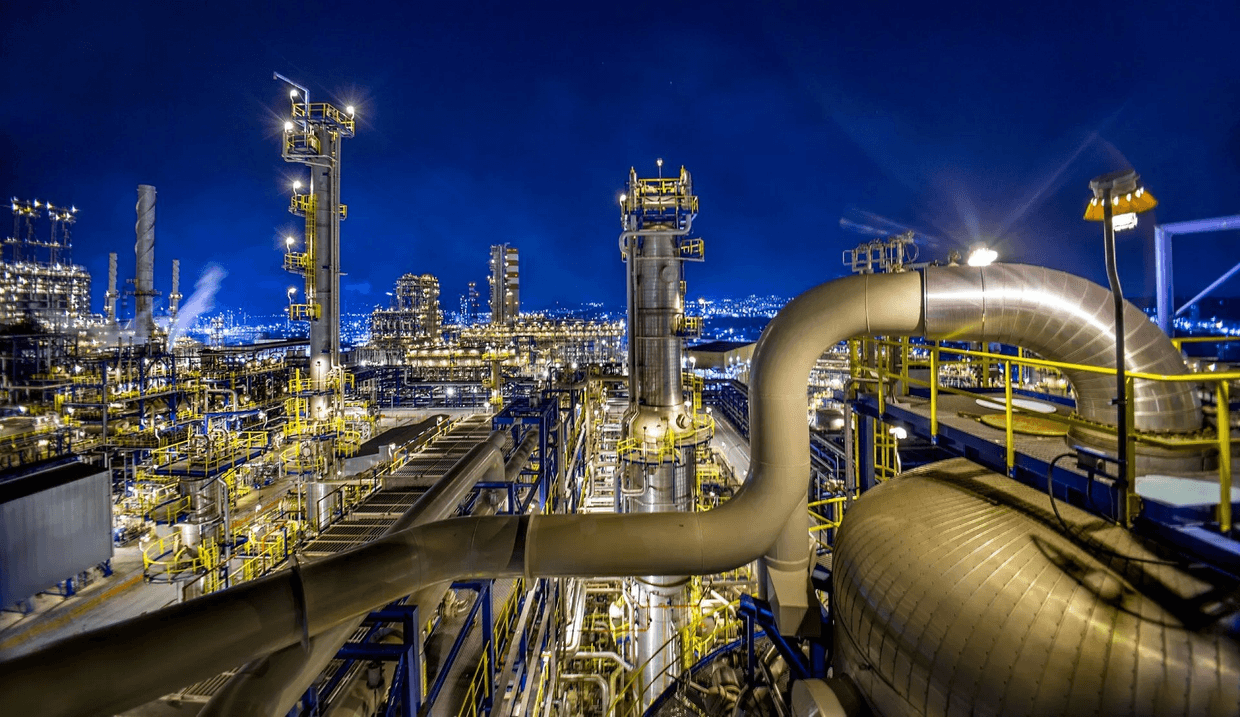

Shah Deniz, which means ‘King of the Sea’ in Azerbaijani, is the country’s largest gas deposit, with estimated reserves of 1 trillion cubic metres. BP holds a 29.99% stake in the project alongside Azerbaijan’s state energy company SOCAR, Hungary’s MOL, Russia’s Lukoil, and Iran’s Nico.

Since December 2020, Shah Deniz has been supplying gas to Europe, mainly Italy, via the 3,500-kilometre Southern Gas Corridor (SGC) system of pipelines that crosses Georgia, Turkey, Greece, and Albania. Buyers of Azerbaijani gas also include Greece, Bulgaria, Hungary, Romania, and Slovenia; gas is also exported to neighbouring Georgia and Turkey.

In 2024, exports to Europe climbed to 12.9 billion cubic metres, up from 8.1 bcm in 2021 — they are projected to reach 13.5 bcm this year.

To meet the commitments, BP and its partners started exploring opportunities in existing and new blocks in the Caspian Sea. In June 2025, a BP-led group approved a $2.9 billion investment for a new offshore compressor platform at Shah Deniz, designed to extract an additional 50 bcm of gas over the project’s lifetime.

BP also leads the ACG Deep Gas project, targeting reserves beneath the existing Azeri-Chirag-Gunashli (ACG) block of oilfields in the Caspian Sea. Production at ACG Deep Gas is expected to begin early next year.

Together with Shah Deniz and other offshore developments, Azerbaijan’s annual gas exports are expected to increase by 8 bcm over the next five years

‘Azerbaijan is set to increase gas production significantly, but it’s not yet clear where the additional volumes will go’, Ilham Shaban, an energy analyst in Baku, told OC Media.

While the EU seeks more Azerbaijani gas, it has been hesitant to sign long-term contracts or finance pipeline expansions, limiting supply growth, Shaban said. Azerbaijan has therefore pursued direct agreements with individual buyers.

For example, Germany’s Uniper AG recently signed a landmark deal to import at least 1.5 bcm annually from Azerbaijan for the next decade.

According to Azerbaijani President Ilham Aliyev, while Baku is exploring other markets — in July, state energy giant SOCAR began shipping 1.2 bcm a year to Syria via Turkey, with potential for higher volumes if demand increases — Europe remains a priority.

‘Our main destination for natural gas is Europe’, Aliyev said in a recent interview with Al Arabiya. He emphasised that they currently supply gas to 10 European countries, eight of which are EU members, with Aliyev insisting that his country’s role in Europe’s energy security would only grow.

While gas production is rising, however, Azerbaijan’s oil output has been declining for more than a decade. The ACG block, which provides most of the country’s crude oil, pumped about 59 million barrels in the first half of 2025, or 327,000 barrels a day — down from 61 million barrels a year earlier.

Yet, the pace of decline has been slowing, with BP helping to stabilise production through the $6 billion Azeri Central East (ACE) platform, the seventh at the site, which began output in April 2024 and contributed around 25,000 barrels a day in the first half. ACE is expected to add up to 100,000 barrels a day and 300 million barrels over its life.

This article was translated into Russian and republished by our partner SOVA.