Armenia’s parliament has approved changes to the way property tax is calculated despite opposition to the bill including criticism of its timing.

The changes passed both hearings by 70 votes for, 11 against, and with 2 abstentions during an extraordinary session of parliament on 25 June.

If signed by President Armen Sarkissian, the bill will come into effect on 1 January 2021.

It has come under fire both for its timing — as the country grapples with the COVID-19 pandemic — and over fears of gentrification, with speculation that it could force lower-income people to move out from city centres.

Property tax is currently based on the appraisal value of a property as determined by the Cadastre Committee, which the government has said is lower than the actual value of properties. The bill proposes changing the way the Cadastre Committee values properties to bring it closer to its true market value.

Properties valued less than ֏3 million ($6,000), which were previously exempt from tax, will also now be taxed.

During a government session on 27 May in which the government endorsed the changes, Prime Minister Nikol Pashinyan stated that due to the tax’s progressive nature, the changes would lower property taxes for almost 500,000 people.

He said that property taxes would increase for ‘palaces and mansions’.

During the parliamentary session approving the bill, Deputy Finance Minister Arman Poghosyan defended the changes saying they were necessary to pay for adequate communal services, roads, and parks.

He said there was no alternative as local budgets for cities and villages come mainly from property taxes.

According to the new law, six thresholds for tax rates will be imposed on flats and houses.

My Step MP and Chair of the Parliamentary Committee on Economic Affairs Babken Tunyan raised the example of a 120 square metre flat in downtown Yerevan with a market value of $80,000.

While the owners would currently pay annual property taxes of ֏9,000 ($19), he said that according to the new law, they would pay ֏48,000 ($100) annually.

The changes will be implemented gradually over six years.

According to the head of the Cadastre Committee, Suren Tovmasyan, property value will be reviewed every two years. He said that an electronic platform would be launched where people can enter their address to calculate their annual property tax.

The Cadastre Committee started recalculating the market value of properties in 2019 and will publish a database of the results before the law comes into effect.

Fears of gentrification

The government has come under fire for the timing of the bill, with many questioning the appropriateness of raising taxes during a state of emergency and while the country grapples with COVID-19.

However, Deputy Finance Minister Arman Poghosyan dismissed criticism of the ‘untimeliness’ of the bill as an emotional reaction. He said the timing was not relevant as the new tax system would not be implemented today, but gradually over the next several years.

Opposition to the bill in parliament was brought forward by the Bright Armenia Faction. MP Arkadi Khachatryan said the changes were not humane, and that taxes should be based on people’s income as well.

The opposition faction had called on parliament to postpone the vote until 2022, however, this was rejected.

Criticisms toward the bill based on fears of gentrification have also been widespread.

In an interview with CivilNet, President of the Chamber of Auditors, Nairi Sargsyan, said that one-third of Armenia’s population lived or was on the verge of living in poverty and that two-thirds of the population of downtown Yerevan were either pensioners or teachers and academics who received those homes during the Soviet years.

‘Their income, either on pensions or on a teacher’s salary, is not enough for their everyday expenses, forget about an additional tax burden’, he said.

According to Sargsyan, many will be forced to sell their homes and move to the suburbs.

According to Sargsyan, the government’s claims that people living in mansions currently pay low taxes could be remedied by a tax on luxuries.

‘Because of 100–200 mansion owners, the poor population is falling under a heavy tax burden.’

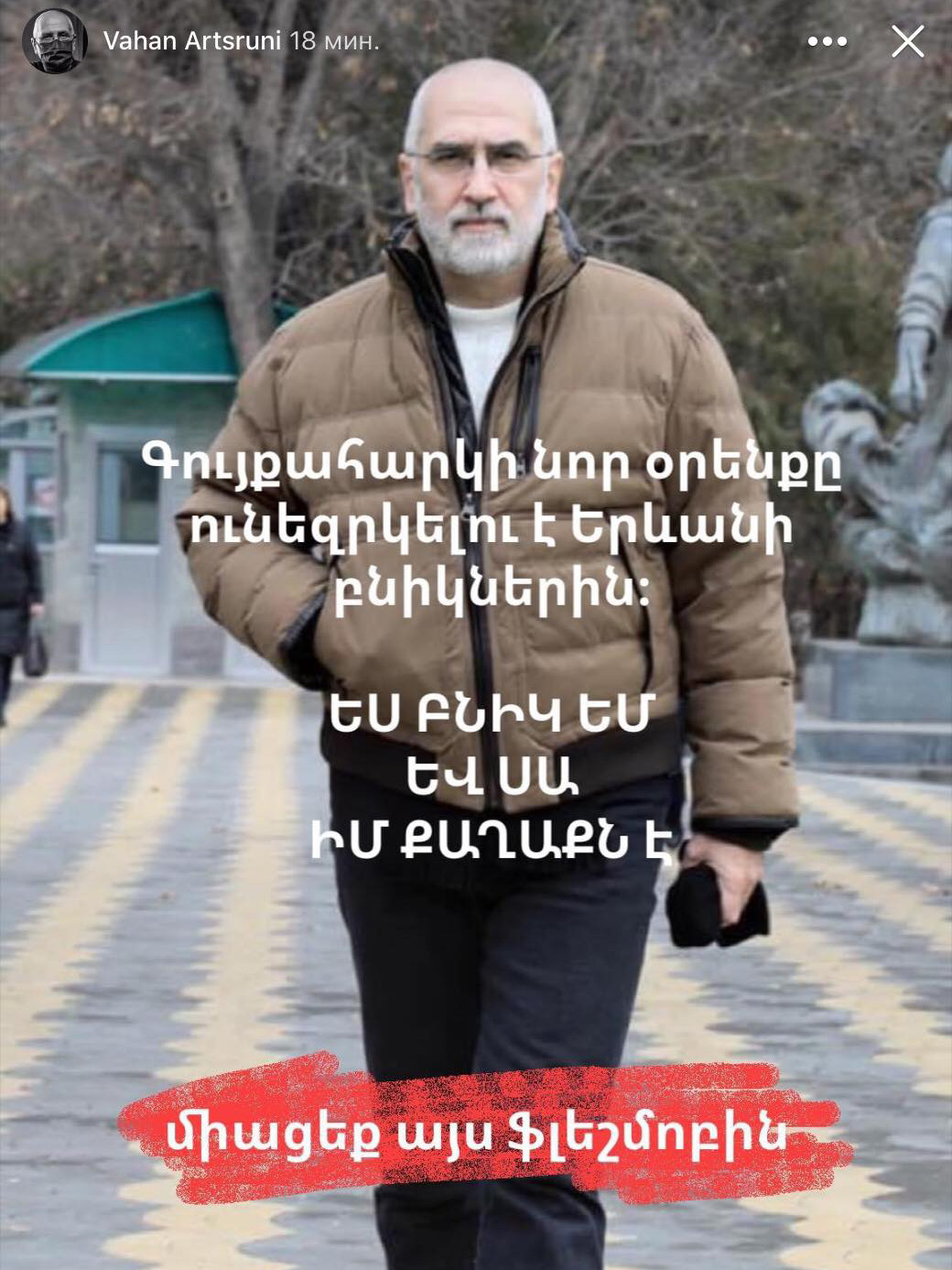

On 27 June, several artists started a Facebook campaign sharing a post by singer and composer Vahan Artsruni calling for all ‘native Yerevantsis’ to oppose the bill.

‘This is a new “way” to alienate or expropriate property which was inherited by us’, the post reads. ‘Think about the future of your children.’

The post was shared over 400 times including by opposition politicians and high-profile reporters.

Though he criticised the post for calling on only ‘native’ residents of the capital, My Step MP Babken Tunyan responded by proposing a public discussion on the new law, despite it already having passed.

A committee of six artists and academics responded that they were willing to meet with Tunyan.

The new law comes after the country switched from a progressive to a flat, income tax of 23% in September 2019.

In response to criticism at the time, the government justified the new taxation system by promising that progressive taxation would be implemented through property taxes and income declaration systems.

A bill on the latter is currently being developed by the Ministry of Finance.